Guest Author

There’s a saying in the world of Economics – If you aren’t paying for the product, you are the product.

We’ve all stumbled upon someone asking us to try free samples. They’re obviously trying to lure you into liking it so that you can buy it later.

However, this basic perspective is important in order to remember this harsh truth – You always get what you pay for. There’s always an amount you will have to invest that comes with a risk, but with just as good an upside if you play your cards right.

Back in the day, large corporations used to do it all the time. Amway, the leading company when it comes to health, beauty, and home care products, was one of the pioneers of door-to-door selling. Thankfully, that’s something you don’t need to do today.

The way that the market works in this day and age is highly complex. Thankfully, there are tons of analytical tools to give us a clear perspective on how we can target our audience.

Basics Customer Acquisition Cost (CAC)

What Is Customer Acquisition Cost?

The cost of getting a customer is Customer Acquisition Cost. Pretty self-explanatory, right? Basically, you incur a huge expense on generating leads, but only a select few end up becoming your customers.

Good thing is that you’ll plan on recovering that expense from the returns from your sales, right? Right.

How to Calculate Customer Acquisition Cost?

You can calculate CAC by dividing your aggregate expenditure (total money you spent on sales and marketing) by the total number of customers you’ve had for that particular period.

For example – If you spent $1000 dollars on PPC Marketing in a year, and you were able to acquire 1000 customers during that period, then your Customer Acquisition Cost would be $1 for each customer.

Why Is It Important to Calculate Customer Acquisition Cost?

It sucks to feel like the market is oversaturated, and even though there are certain industries that are highly crowded, you’ll have to put as much active effort in order to make your place.

The reason why you need to calculate Customer Acquisition Cost is to get a perspective on whether you’re spending too much or too little on your sales plan and marketing operations.

There’s a standard conversion rate that is typical for every industry. For example, if you’re a Digital Marketing Agency, a good conversion rate can be around 3%.

As a rule of thumb, you can see that if the Customer Acquisition Cost is high, you aren’t getting enough conversions and vice versa. Besides, the goal is to reduce CAC with time which is not necessarily in correlation with how good your conversion rate is.

What Is the Ideal Customer Acquisition Cost Ratio?

We already understand what CAC is, what we do need to understand is the term Customer Lifetime Value (CLV), because the CAC ratio is going to be between CAC and CLV.

Customer Lifetime Value is simply the total amount the consumer is going to spend on your product/services during their relationship with your company.

This is the most important metric for eCommerce businesses built on platforms like BigCommerce, and especially for businesses that cross-sell, upsell, and have subscription-based models.

It goes to show how healthy your customer base is, which subsequently indicates the rate of organic business growth in the future.

A good CAC ratio would be one where the CAC is low and the CLV is high, which is pretty obvious from what we know about these terms.

A good business will have a CLV: CAC ratio of 3:1. This indicates that an average consumer spent 3 times more than what you spent to get them. And obviously, the more, the merrier!

Ways to Reduce Customer Acquisition Cost

Now that you understand how to calculate the Customer Acquisition Cost and its implications, let’s look at the ways in which you can keep that cost at the minimum:-

Get a Partner Program

Did you know that the biggest names in the tech industry from Apple, Microsoft, Salesforce, Adobe, SocialBee to vendors and small-scale businesses have partner programs?

A partner program is simply an exchange of services between you and your vendors (channel companies) where you as a business owner offer incentives, discounts, technical training and support services, etc to your vendors in exchange for promotion and recommendation of your products.

Partner programs can be segmented in order to accommodate the specific needs of particular types of channel companies. Therefore, the vendor will deploy multiple engagement models.

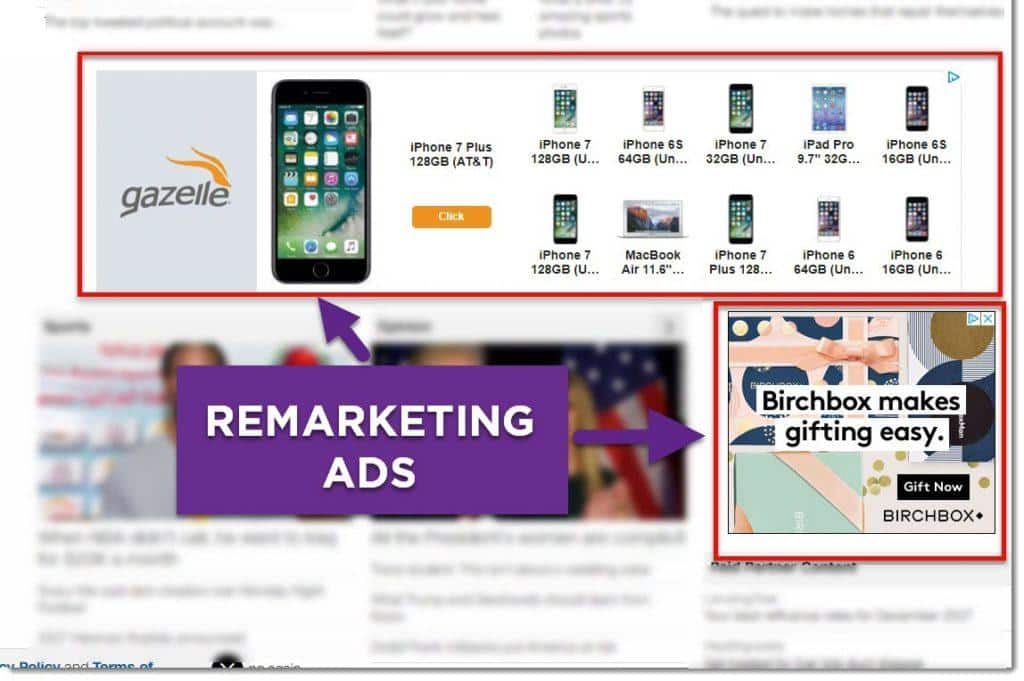

Remarketing

Retargeting is usually about serving ads to potential customers (your web traffic) based on cookies. When the traffic visits your website, scrolls through your service page, and leaves, you can retarget them with relevant ads on various websites or social media pages.

Remarketing includes retargeting and is also about sending emails to the leads who have signed up via email. It works by collecting the information of users and creating email lists, which are used later to send sales emails.

Remarketing and Retargeting are investments that can take some spending initially, but the returns it brings, in the long run, will gradually reduce your Customer Acquisition Cost.

Reduce the Cost of Labor

It clearly matters how much you’re spending on your vendors that are providing digital marketing and other commission-based services. The commission is based on a percentage that makes sense initially, but as your company grows, the expenses will start growing proportionally.

Here, you have to keep an eye on the income you’re getting because when you reach a point where you can hire 1 or 2 in-house employees to perform the same services, you can stop relying on external vendors.

For example, if you’re relying on an agency for PPC and Social Media Advertising, and you’re paying $3,000 + 7% commission of your sales every month and are getting sales of $10,000/month, then you’re paying $3,000 + $700 (7% of $10,000), which is $3,700.

As soon as your sales hit, let’s say, $25,000/month, you may choose to hire an in-house digital marketing expert who will take care of the same at $4,000/month, which would’ve otherwise cost you $3,000 + $1,750 (7% of $25,000) = $4,750.

Automate the Nurture Sequence

Did you know that 92% of your website traffic isn’t there to avail of your services? Most people believe that you can only sell to the remaining 8% but the truth is that you can even convert 3% of the 92% of visitors that aren’t even interested at the moment.

Truth is, it takes 6 – 12 months of churning to be able to convert them because they aren’t interested *at the moment*. Hence, you have to create awareness, generate interest, and induce a desire so as to get them excited to buy your product/service.

You have to create a lead magnet, i.e. a blog, ebook, or video series that adds value to their ongoing operations and advertise that to collect emails as we discussed above in the “Retargeting and Remarketing” head.

Use Drip or MailChimp to send automated emails. Time and again, you’ll have to create relevant email posts based on what they’re more inclined towards.

For example, if you have 4 online programs, then you have to segregate which leads are inclined towards which program more in order to send them relevant posts.

Automated Marketing campaigns could seem costly initially, but over a period of time, not only they’ll be economical but also more effective.

Build Trust

At first glance, it seems pretty obvious for you to want to build trust if you’re planning on growing your business in the long run, but to understand that it’s eventually going to reduce your Customer Acquisition Cost is all the more reason to think about it.

Building trust takes time. The greatest way to build trust is social proof. As soon as you get clients on board, you have to request them to leave feedback about your service on your website. In order to get reviews, you can offer your service at a competitive price.

Apart from social proof, you have to make sure that you’ve provided every little detail that a consumer would need if they were to choose you over your competitors.

Make sure you have your office address, work phone number, even an FAQ section on your website that elaborates on major pain points and dilemmas before hiring you. This all will contribute to building trust and gradually improving your CAC.

Invest in Content Marketing

Used to be underestimated a long time ago and has caught up gradually with every business that’s trying to grow in a competitive market, content marketing is one of the greatest ways to reduce your Customer Acquisition Cost. How?

Well, because of Search Engine Optimization (SEO). The principles of SEO are primarily based on using relevant keywords that will help optimize search results and rank you accordingly.

Not only that, but the more frequently you update your website, the better it is for ranking on search engines. This is different from advertising because you’re showing up in organic search results, which builds trust, which means more buyers, which means a reduced CAC.

Over to You

There are several other ways to understand how to reduce your Customer Acquisition Cost and although this blog is really comprehensive, it barely scratches the surface, because the possibilities are endless. What are you doing to keep your CAC at a minimum?

Devansh is an avid content creator who loves writing about things that are mainly associated with Business and Technology. He also writes about Web Development, UI/UX Design, Marketing, even Machine Learning, and AI. He’s currently working with RNF Technologies.

Customizable tone of voice

Customizable tone of voice  Several variations to choose from

Several variations to choose from  1,000 pre-made AI prompts

1,000 pre-made AI prompts